- #LONG TERM STOCK PROFIT CALCULATOR HOW TO#

- #LONG TERM STOCK PROFIT CALCULATOR FULL#

- #LONG TERM STOCK PROFIT CALCULATOR FREE#

Thus, when calculating your capital gains from crypto, you should aggregate all your cryptos bought or sold over the course of the year minus the cost basis (price at which you bought or received) of each respective asset. That means that when you sell or trade crypto, you have to report your capital gains or losses to the IRS.Ĭapital gain is the difference between the price at which you sold your crypto and the price at which you bought it.

The IRS qualifies cryptocurrency as an asset, comparable to a stock, not a fiat currency (like Euro, USD, or Yen). Let’s start with how crypto taxes in general are calculated.

#LONG TERM STOCK PROFIT CALCULATOR HOW TO#

IRS Rules On How to Calculate Cryptocurrency Taxes Let’s explore how to calculate your crypto taxes and also see how ZenLedger’s cryptocurrency calculator can help simplify the process. That’s why you need to know how to calculate taxes on crypto by using a cryptocurrency tax calculator. Taxes are already a very complicated and confusing topic, but in the world of crypto, with so many different exchanges, wallets, and transactions, it’s impossible to manually calculate all gains and losses. And yes, the IRS has the means to control that. Yes, you read it right: you must pay taxes on cryptocurrency. What Is A Crypto Tax Calculator?Ĭryptocurrency represents a great opportunity to diversify your investment portfolio, maximize your profits, and… save on your taxes. For a more detailed explanation of the changes and general filing best practices, see our 2021 Guide to Cryptocurrency & Bitcoin Taxes. Note that holding or moving cryptocurrency between wallets does not count as acquiring. If you did make a crypto purchase during 2021, make sure to answer yes to the following question on your 1040 form: “At any time during 2021, did you receive, sell, exchange, or otherwise dispose of any financial interest in any virtual currency?” Therefore you must learn how to calculate your crypto taxes!

Cost of stocks sold or acquired through inheritance, gift, ESPP, or RSUs use different costing methods that are not covered in our Capital Gains Interactive Calculator.Filing your taxes? Be aware that in 2021 the IRS now requires you to disclose any cryptocurrency purchases made as part of a 1040 filing. In most cases the cost of stock is the amount you pay for it. *Note, our Capital Gains Interactive Calculator is for estimation purposes only and does not include all investment and stock situations.

#LONG TERM STOCK PROFIT CALCULATOR FULL#

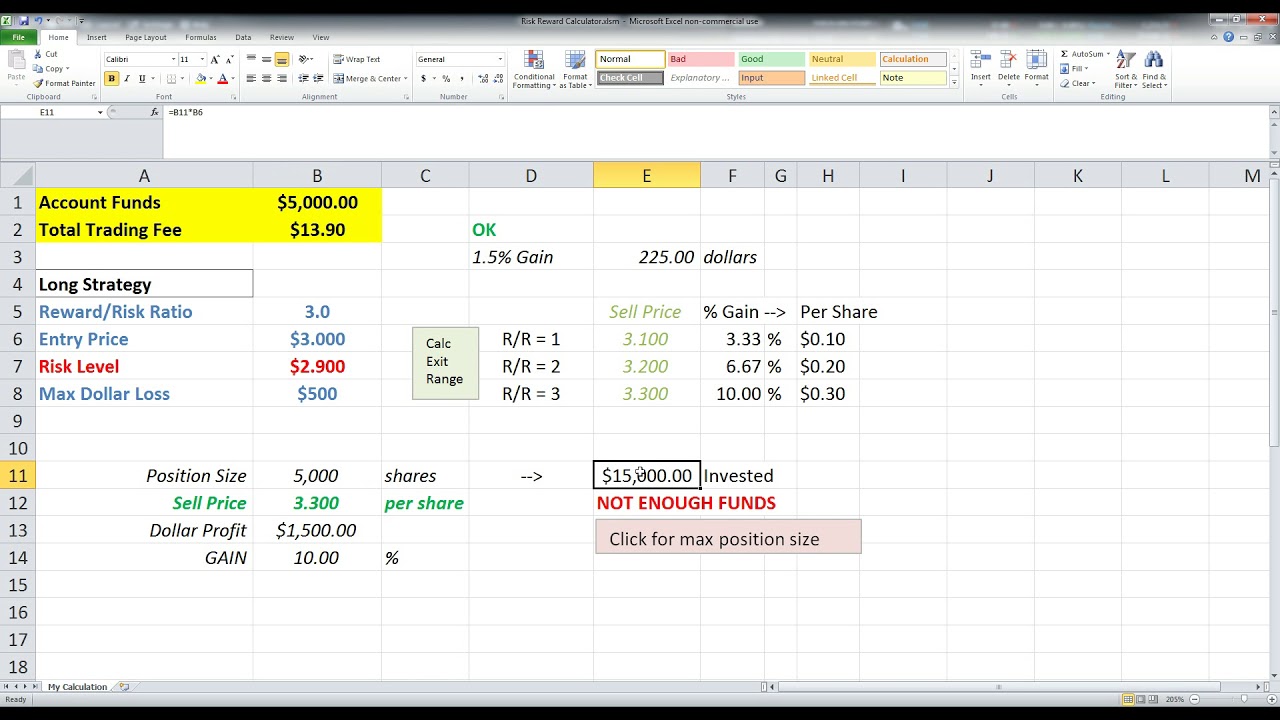

You can also connect live via one way video to a TurboTax Live Premier tax expert with an average 12 years experience to get your questions answered along the way or be matched with the right TurboTax Live Premier Full Service tax expert experienced in your specific tax situation who can also do your taxes from start to finish. Īt tax time, TurboTax Premier will guide you through your investment transactions, allow you to automatically import up to 10,000 stock transactions at once, and figure out your gains and losses. T o help you with your tax planning you can also find out if you have a capital gain or loss and compare your tax outcome of a short term versus long term capital gain, whether you already sold or you are considering selling your stock.

#LONG TERM STOCK PROFIT CALCULATOR FREE#

Are you one of the lucky investors? If so, you probably have some of the top questions we hear like, “ How much will my stock sales be taxed?”, “ What is a capital gain or loss?”, and “What is the difference between short term versus long term gains?”Ĭheck out our free Capital Gains Interactive Calculator, that in just one screen, will answer your burning questions about your stock sales and give you an estimate of how much your stock sales will be taxed and much more.

Many of them making huge gains on their sales. When stock market prices took a dive at the beginning of COVID-19, millions of people jumped into the stock market to take advantage of the low prices and millions also sold stock for the first time last year.

0 kommentar(er)

0 kommentar(er)